Products¶

Creating a Product¶

Your organization’s offerings be it “Goods” or “Services” are created using the steps below.

To create a product please follow the steps below:

In HRM container, go to Product Folder

In Product Folder, click on “Actions” and select “New Products”

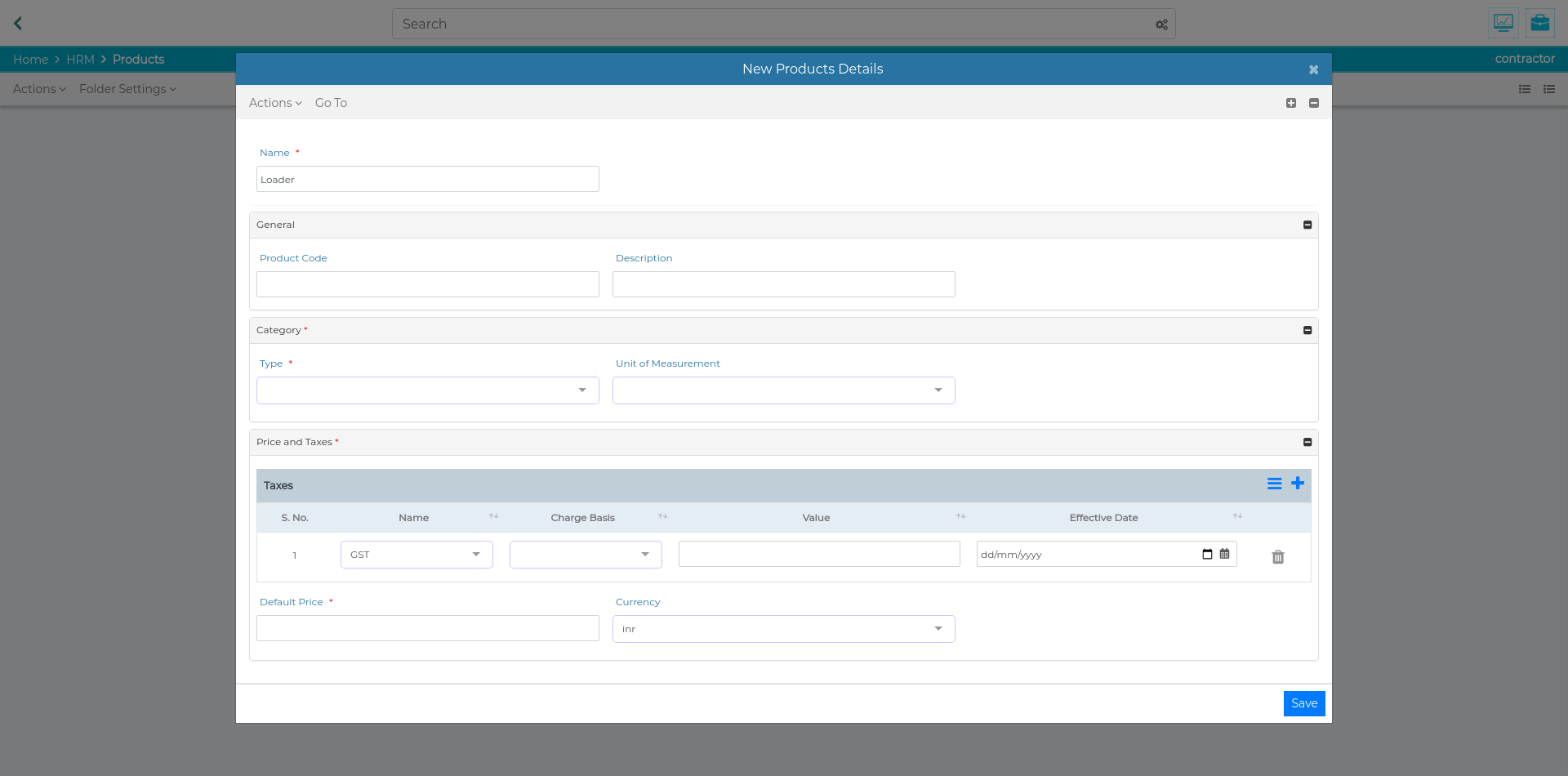

A New Product’s Details window will pop on the screen.

Fill in the name of the product

Click on the “+” sign in front of “General”

Enter the product code and description

Click on the “+” sign in front of Category

Select the type of product. The type is further explained below

Enter the unit of measurement

Click on the “+” sign in front of “Prices and Taxes”

Enter the tax details by clicking on the “+” sign in front of “Taxes” .

If any more tax is applicable on the product, repeat step 11 for adding the tax information

Enter the default price and currency

Click on “Save”

Please note, in case of services, the organization offers manpower where in the employee designations are considered as products.

Mandatory Fields for creating a new Designation/Product record¶

The following fields are mandatory and you’re requested to fill at least the following in order to successfully create a designation/product.

Name: Please enter the name of product in this section.

Category: This defines the product type and units of measurement. Click on the “+” sign to fill in the details

Type: From the drop down menu, select the type of product (Goods or Service). In case of service select the sub type through the drop down menu.

- Subtype: Select the type of service from the three available options

Attendance Based: Used for services which are measured on the basis of mandays

Job Based : Used for services pertaining to jobs

Fixed rate: Used for services to be provided for fixed rates

Unit of Measurement: Select the unit of measurement for the offering. In case of a service, it could be as per the work that is to be performed by the employees.

Prices and Taxes: Used to define the price at which the product is to be sold and the expected tax slab. Please note that this tax would be automatically used in the invoices generated for the respective product.

Default price: The basic price at which the product is to be sold. This is the rate that will be considered if not specified.