Reports¶

Creation of Invoice and Payslips will automatically generate reports. You can check these reports by following the steps below:

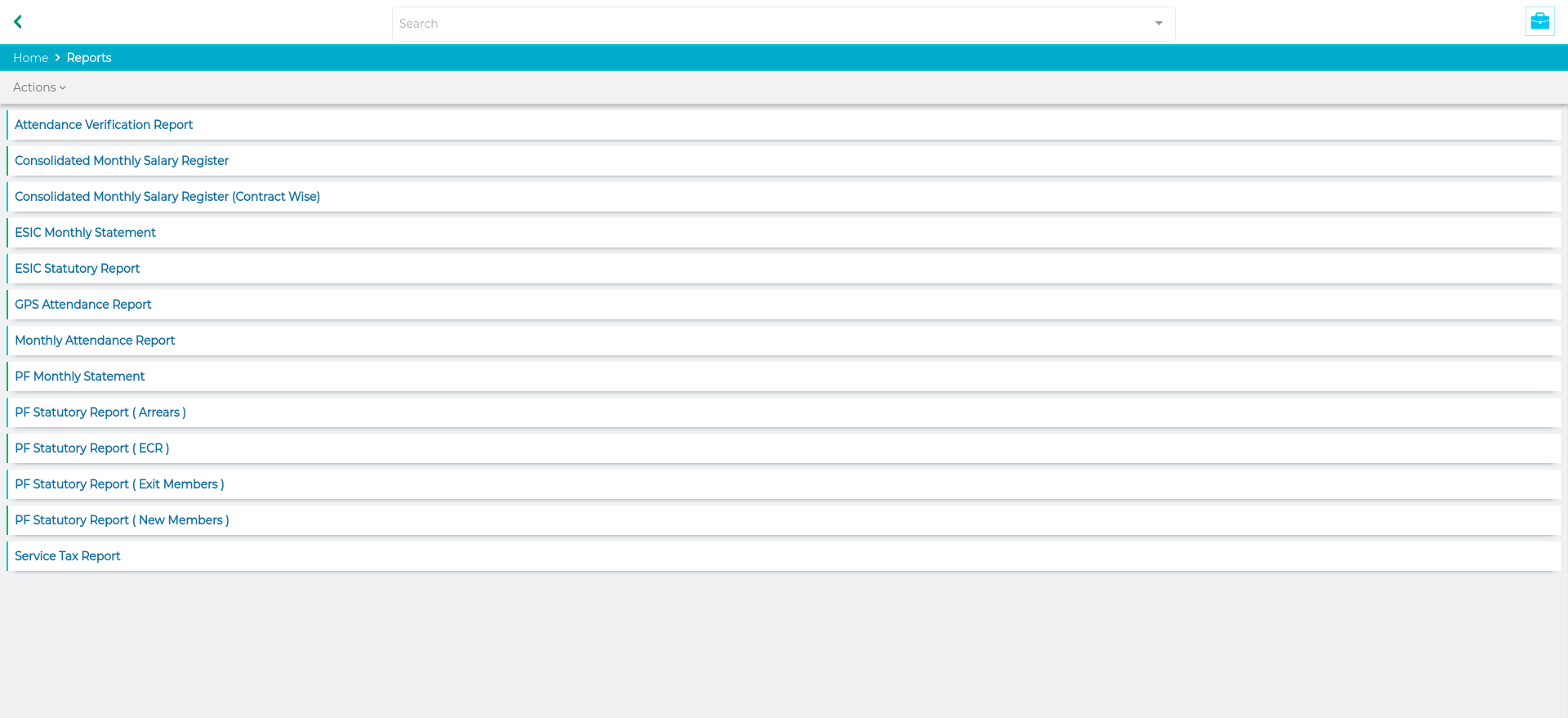

Go to Reports Container

A list of reports will appear on your screen.

Click on the report you wish to see.

Fill in the necessary fields

Click on “OK”.

Saralweb’s WFM allows you to get automated reports which can be exported from the system and can be uploaded on government’s portal directly. The various reports available are

Compliance Reports

Bonus Report, Rule 4, Form C

ESIC Monthly Statement

ESIC Statutory Report

Employee Register, Wages Code(Form IV)

Employer EPF and ESIC

Labour Welfare Fund Summary

Monthly Deduction Register

Monthly Employer PF Contribution Summary

Monthly Termination Summary

Monthly Wage Register

PF Monthly Statement

PF Statutory Report ( Arrears )

PF Statutory Report ( ECR )

PF Statutory Report ( Exit Members )

PF Statutory Report ( New Members )

Professional Tax - Monthly Statement

Register of Overtime ( CLRA, Form XXIII)

Register of Wages (CLRA Form XVII)

Register of Wages, Overtime, Fine, Deduction for damage and Loss (OSHWC Code : Form VIII)

Register of Workmen ( CLRA Form XIII)

HR MIS

Bank Information

Annual Bonus Report

Employee Grades

Employees Interviewed

Employees with Pending Details

New Joiners in the Month

Organization Structure

Salary Register

Contractors Invoice Register